Our latest news and analysis.

Growth CapEx versus Maintenance CapEx (And Why It Matters)

CapEx (or “capital expenditure”) is money spent by a company on assets that are anticipated to provide an enduring benefit to the business of usually 12-months or more. For example, when a company buys a new piece of equipment for its factory, it is anticipated that the equipment will provide a long-term benefit to the organisation’s productive capacity.

When is CapEx not CapEx

Before explaining the difference between maintenance CapEx and growth CapEx, it is important to firstly distinguish CapEx from two other types of expenditure on assets.

- If a company is in the business of buying and selling equipment, then any purchases of new equipment would on face value be deemed to be working capital (ie. inventory) rather than CapEx; and

- If a company spends money on equipment but the benefit of that expenditure is deemed to not provide an enduring benefit, the money spent would most likely be classified as repairs & maintenance rather than CapEx.

These distinctions are important for accounting purposes.

CapEx does not go through a company’s Profit & Loss statement. Rather, the expenditure goes through the cash flow statement and is capitalised as an asset on the balance with wear and tear periodically recognised as depreciation expense in Profit & Loss.

By contrast, both the purchase of inventory for the purposes of re-sale and expenditure on repairs and maintenance of capital equipment go through the company’s Profit & Loss, thus reducing earnings for the period.

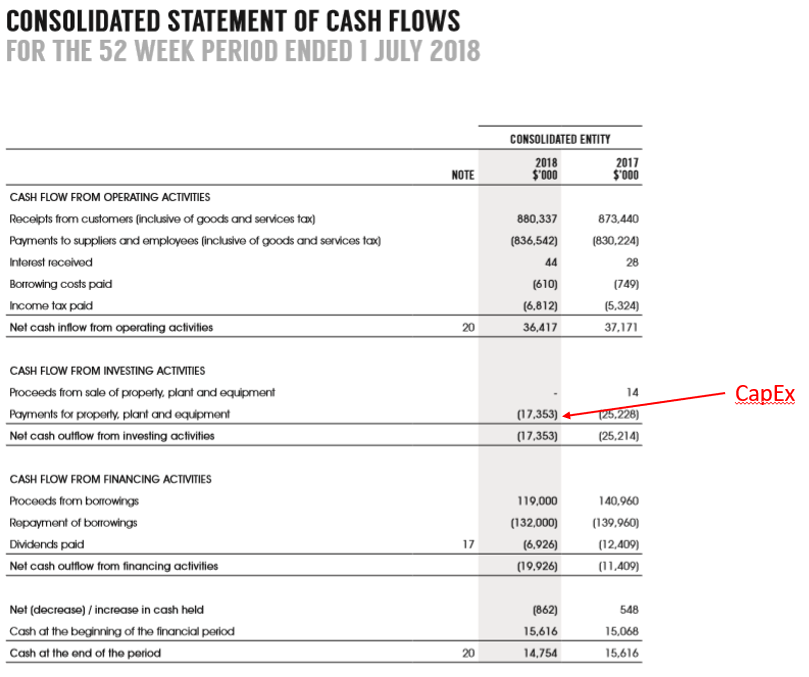

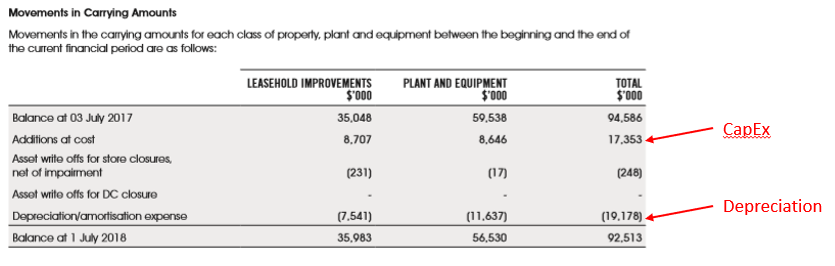

Let’s take a closer look at these distinctions using the 2018 financial report of The Reject Shop. In Financial Year 2018, the company spent $17.35m on CapEx, which appeared in the company’s cash flow statement.

This $17.35m in CapEx increased the carrying value of the company’s non-current assets on its Balance Sheet, which were also reduced by the period’s $19.17m in depreciation, which went through The Reject Shop’s Profit & Loss.

What is clear is that defining an amount as CapEx rather than an expense increases a company’s earnings and assets for the period.

Growth versus Maintenance CapEx

With the definition and treatment of CapEx now clear, it is important to be able to distinguish between two different types of CapEx: maintenance CapEx and Growth CapEx. While being able to draw this distinction can be challenging in practice, the principle is important.

Maintenance CapEx refers to CapEx that is necessary for the company to continue operating in its current form.

Growth CapEx is expenditure on new assets that are intended to grow the company’s productive capacity. Growth CapEx is discretionary in that unlike maintenance CapEx, if the company decides not to proceed with growth CapEx, the business will still be able to operate in its current form – though perhaps below management’s expectations.

To highlight the distinction, consider the retail giant Woolworths. It could be argued that when Woolies refurbishes an existing store – laying new flooring, painting the walls, replacing old fridges etc. – it is engaging in maintenance CapEx.

By contrast, when Woolworths opens a brand new supermarket, it is more likely this would be considered growth CapEx because it is expanding the company’s asset base and productive capacity. Often, in practice, such stark distinctions are not as obvious and judgement needs to be exercised.

That is why in a business sale transaction, a key part of the due diligence process will be conducting a detailed review of the company’s non-current assets and determining the level of maintenance CapEx required.

One relatively crude way to differentiate between maintenance and growth CapEx is by comparing a company’s depreciation and CapEx figures. The extent to which CapEx exceeds depreciation could be considered growth CapEx because it is expanding the asset base beyond wear and tear. Indeed, when a company’s depreciation charge consistently outstrips its CapEx, equity analysts often question whether the business is adequately re-investing in its future.

Why It Matters

The question then arises why the distinction between maintenance and growth CapEx is important. The reason is that the level and timing of required maintenance CapEx has a direct impact on a company’s cash flow.

If a company’s maintenance CapEx is relatively high, the company’s free cash flow will be relatively low. Free cash flow is the cash available for repaying debt and making dividend distributions after operating expenses and capital expenditure commitments have been paid.

If future maintenance CapEx is expected to be high free cash flow has the potential to turn negative. In these circumstances, the company will need to find new sources to fund this gap (debt or equity), assuming existing cash balances are insufficient.

These funding sources may not be readily available, may be dilutive or expensive. That is why a potential acquirer of a business will pay close attention to the maintenance CapEx of a potential acquisition going forward.

This is also why a business with high free cash flow is relatively more attractive because it can borrow more heavily to boost returns, can pay out larger dividends to shareholders and is better positioned to weather any unexpected slowdown.

In a such a slowdown, while growth CapEx, which is discretionary can be delayed or cancelled, maintenance CapEx cannot be avoided without doing harm to the business’ underlying productive capacity.

The difference between maintenance CapEx and growth CapEx is an important concept in corporate finance and is particularly important in the context of a business sale transaction. If you would like to have a confidential discussion about how CFSG can assist you in successfully preparing for and completing the sale of your business, please contact us.