Our latest news and analysis.

Why a bigger businesses is more valuable*.

(* – all things being equal!)

As advisers we speak to business owners at all different stages of their exit journey. Some business owners that we speak to are for various reasons keen to get out almost immediately. That scenario leaves little time for preparation and planning, and it is then just a case of quickly tidying up the business so that it presents its best possible self to the market.

A totally different scenario is the business owner who says that they are keen to exit their business over, say, the next three-to-five years. Clearly, that offers significantly more time to prepare the business for a sale and to put in place as many of the standard elements that maximise a business’ market value – layers of management, robust systems and procedures, documented contracts and so on.

The other key opportunity that such a lengthy exit time frame offers is the chance to significantly scale up the business. This growth can be organic (ie. growing the existing business) or growth via acquisition – or both.

The first question that we are commonly asked by a client considering scaling their business is whether it is even true that larger businesses do, in fact, sell for higher multiples. Clearly, seeking to grow a business takes effort, often requires capital, and carries a level of risk. Is it justifiable in terms of eventually achieving a higher exit price?

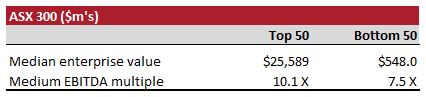

On this question, the evidence is clear. Larger businesses – all things being equal – are valued more highly than smaller businesses. To demonstrate this phenomenon, we analysed the ASX 300 – the largest 300 companies on the ASX. We divided that index into the largest 50 companies and smallest 50 companies. The largest cohort of companies traded at a median EBITDA multiple of 10.1-times whereas the smallest cohort traded at only 7.5-times.

While it is true that all the companies analysed are relatively large public companies, what is clear is that the market on average values larger businesses more highly than smaller businesses. This should provide a valuable insight and motivation for any business owner considering selling their business: they are likely to achieve a higher sales multiple if they can increase the overall size of their business.

Why is bigger better?

This then raises the obvious question: why does the market generally apply a higher valuation multiple to larger businesses?

A key reason for this phenomenon is that investing in or acquiring a larger business is seen as fundamentally less risky. Larger businesses are generally more robust and better positioned to withstand shocks than a smaller business – again, all things being equal. There are many reasons for this perception. Larger businesses generally have:

- Longer track records with likely more experience navigating changing market conditions;

- More robust balance sheets than can better withstand a poor financial quarter or half;

- Greater access to funding sources via debt and equity markets;

- More diversified customer bases made up of more substantial businesses;

- Greater depth of management with less reliance on a key person or persons;

- Stronger ability to attract and retain talent by leveraging a more established brand name;

- Greater economies of scale by being able to spread costs over greater sales volumes.

Clearly, the above list is not exhaustive. It is also important to acknowledge that a larger business will not automatically sell for a higher multiple than a smaller business. There are cases from time to time of smaller businesses that attract exceedingly high multiples because of their strong growth trajectories, unique skills, technologies, customers and so on.

There are also times when a smaller business can attract stratospheric multiples because of unique market circumstances. The 2015 purchase of EatNow / Menulog by the UK-listed JustEat for $800m+ being a case in point.

Nevertheless, for a business owner considering an exit over the medium-term, having a clear focus on growth could well be the key to unlocking the sorts of multiples and values that they are seeking. If you would like to discuss your growth or exit plans, we invite you to contact us.