Our latest news and analysis.

Enterprise Value versus Equity Value

Equity Value

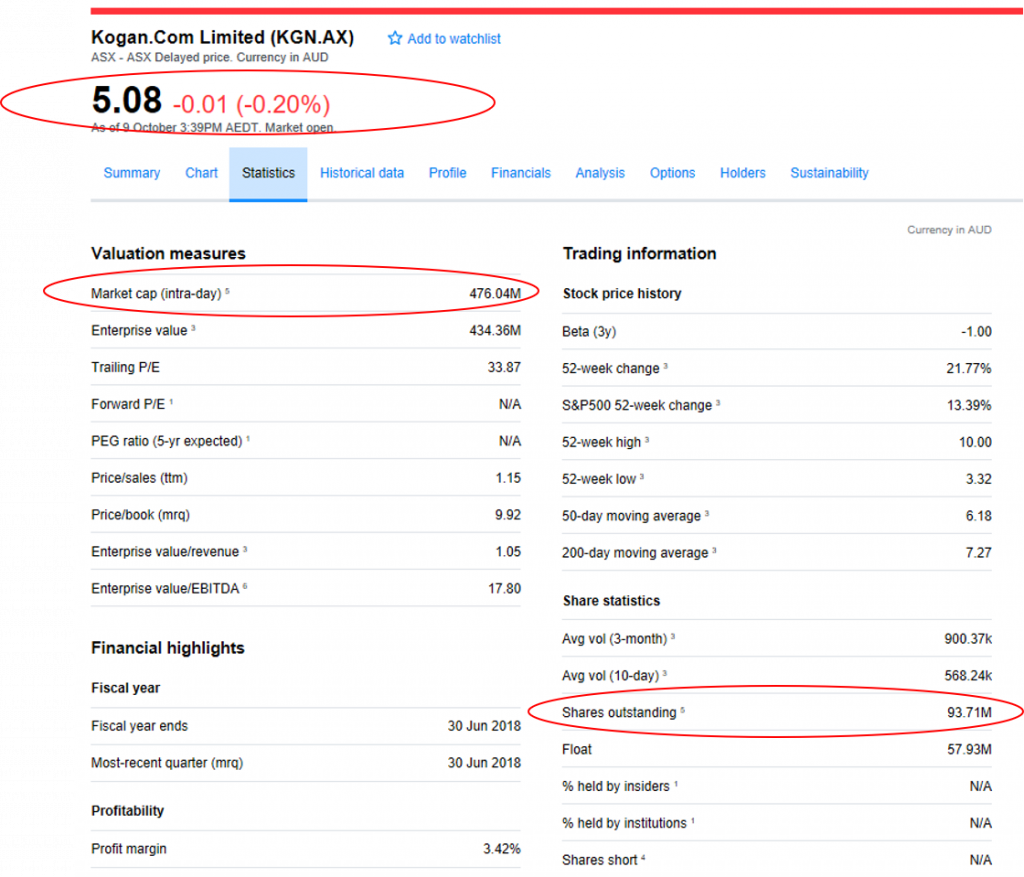

Importantly, the company’s market capitalisation of $476.0m is not the same as the notional equity value that is shown in Kogan’s balance sheet. The company’s balance sheet shows issued capital of only $167.3m.

This difference is due to the fact the issued capital figure in the balance sheet shows what investors originally paid for the company’s shares whilst Kogan’s market capitalisation shows the current market value of those shares.

Thus, a company’s equity value is the current market value of the company’s shares – whether those shares happen to be publicly traded or not.

Enterprise Value

By contrast, a company’s enterprise value is the value of the company as a whole. In other words, enterprise value recognises that in addition to a company’s shareholders, there may be other groups that have a claim over the company’s assets. The most common additional group with such a claim is the company’s lenders.

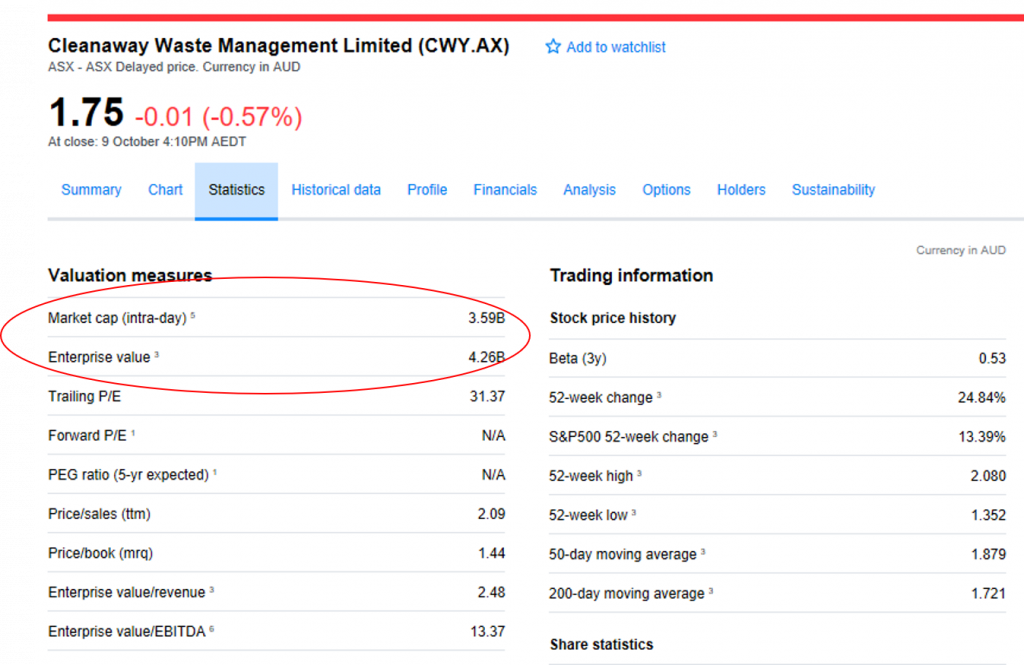

Using Cleanaway Waste Management Limited, the listed waste management company as an example, we can see that while the company’s equity value (or market capitalisation) is $3.59B, Cleanaway’s enterprise value is significantly higher at $4.26B.

It is also worth mentioning that while debt is the most common additional claim that makes up a company’s enterprise value, there are other possible claimants that need to be considered including, for example, the holders of preference shares and non-controlling interests.

Private Company Sales

For listed companies, calculating equity value is entirely straightforward because there is an active market for the companies’ shares. However, for private companies where no such market exists, calculating equity value is more difficult.

In practice, calculating equity value for private companies is typically achieved in reverse. The company’s enterprise value is usually calculated first, most likely through the application of a multiple against EBIT or EBITDA with net debt then removed.

Enterprise Value (say, EBITDA x EBITDA Multiple)

Less: Value of Debt

Add: Cash Balance

Enterprise Value

The difference between equity value and enterprise value is a key concept in corporate finance and is particularly important in the context of a business sale transaction. If you would like to have a confidential discussion about how CFSG can assist you in successfully preparing for and completing the sale of your business, please contact us.