Our latest news and analysis.

Marketing Growth Engine – Why Your Start-Up Or Early-Stage Business Needs One

CFSG Ventures, the venture capital arm of the Concept Financial Services Group, focuses on investing in start-up and early-stage business to help them grow fast.

Our differentiator is that we not only provide the capital young companies need to grow but also the know-how to build a marketing growth engine – an efficient, predictable and scalable system for driving exponential sales growth.

It’s a process that we have successfully gone through with several start-up companies such as Need a Barista, Australia’s number one barista staffing solution. For a detailed overview of our investment in Need a Barista, click here.

We are often asked why growth is such an obsession for early-stage investors like CFSG Ventures. The simple reason comes down to valuation.

Growth, or the expectation of future growth, is what underpins the enormous valuations of so-called Silicon Valley unicorns – start-up companies with valuations in excess of $1.0b. And it’s this valuation upside that justifies the risks of investing in young businesses.

What Drives A Start-Up’s Valuation?

In finance theory, a business is valued by calculating the present value of its future cash flows. The standard way for doing this is through a discounted cash flow model or DCF.

A DCF forecasts a company’s future cash flows over an explicit period of, say, five or 10 years and then adds what is called a terminal value to account for the cash flows the business will generate beyond the explicit forecast period.

Once these cash flows have been calculated, they are “discounted back” into today’s dollars by a discount factor that allows for the time value of money and the perceived risk of those relevant cash flows.

The higher the perceived risk of the cash flows materialising, the higher the discount rate that will be applied. Essentially, the discount rate compensates early-stage investors for the risks they are taking with their funds.

What does this have to do with marketing growth engines?

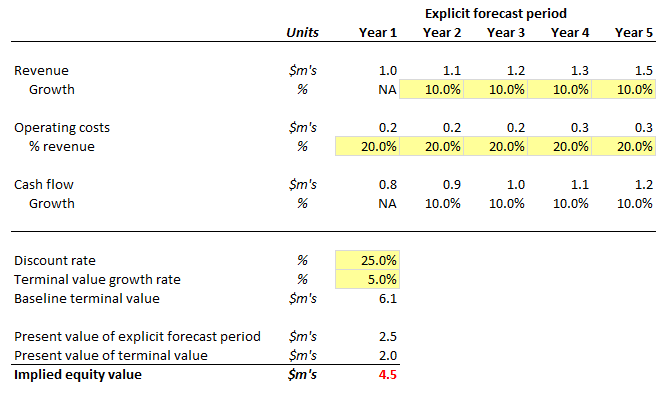

Below is a highly simplified DCF for a fictitious company that forecasts the company’s cash flows over five years and then calculates the business’ terminal value. Revenue is forecast to grow at a steady 10% per year and the terminal value by 5% thereafter.

The analysis yields an equity value for the company in today’s dollars of $4.5m.

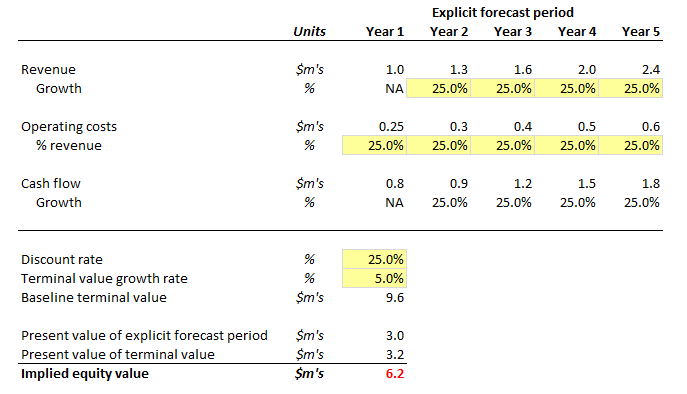

Now, let’s assume that the company invests heavily in growth marketing tactics, which increases its operating costs as a proportion of revenue from 20% to 25%. However, let’s assume that this investment results in revenue growing by 20% per annum rather than just 10%.

We can even afford to keep the terminal growth rate – the expectations for growth beyond the explicit forecast period – the same at 5%.

Even after spending an additional $0.8m on growth marketing-related expenses, if that expenditure translates into a sustained increase in revenue as assumed above, the company will add a net $1.7m to its value.

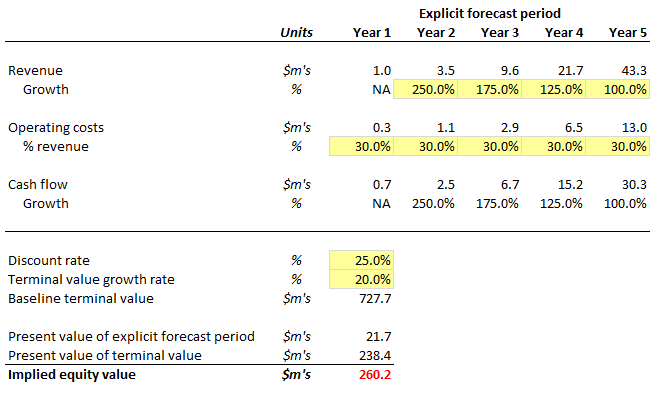

That’s not a bad outcome if you are an investor. However, it’s still not a stellar performance. Pushing the example further both in terms of forecast revenue growth and the terminal value growth rate shows just how important growth is to a company’s valuation.

Assuming the company’s growth marketing activities caused the business’ revenue to explode in the forward years, the company could multiply its value by more than 40 times. These are the sorts of returns that early-stage investors and the founders they back are looking for.

What Is A Marketing Growth Engine?

The companies that successfully unleash the sorts of growth that drives these exponential valuations all share one common attribute: they all have developed their own unique marketing growth engine to cost-effectively scale.

And that is why CFSG Ventures places such a focus on helping its portfolio companies build their own marketing growth engines.

A marketing growth engine isn’t simply deciding to put some dollars behind SEO or Facebook ads, investing in content marketing or an email campaign. It might be all those channels or something completely different.

It’s ultimately about following a holistic, metric-driven and creative process for finding the fastest and most affordable path for exploding a company’s sales growth by developing integrated tactics through a company’s entire sales funnel.

Simply put, the goal of a marketing growth engine is to develop a repeatable strategy where a company can invest $X’s into marketing and confidently expect a return of $Y’s. It’s that predictability that excites investors to back an early-stage business.

Building A Marketing Growth Engine

To build a marketing growth engine, CFSG Ventures works collaboratively with each start-up or early-stage company it invests in and follows a rigorous and systematic process to build a bespoke solution that will serve as the company’s central platform for future growth.

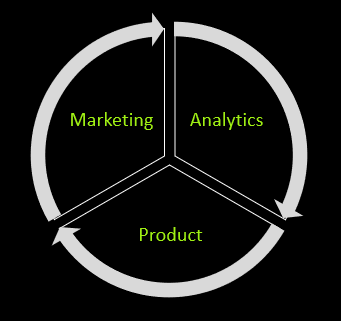

Unlike old-school marketing that viewed marketing as a standalone business function, building a marketing growth engine recognises that a company’s marketing and product development functions are inextricably linked.

The marketing team provides the product team with real-world data on the extent of product/market fit. As the product team continues to refine its product in response to that feedback, it enables the marketing team to promote an ever more attractive offering into the market.

This process creates a virtuous loop that benefits the entire company.

At the core of a successful marketing growth engine is a focus on data and analytics. The proliferation of data in the digital economy enables marketers to rapidly assess the success of all marketing initiatives and in turn provides the product team with actionable insights.

Marketing growth engines also rest on a deep commitment to rapid experimentation and continuous optimisation – across both digital and any non-digital channels and strategies – to maximise the efficiency and effectiveness of the company’s sales funnel.

When you have skin in the game, what matters is what works – not what might be trendy in marketing circles.

When A Company Lacks a Marketing Growth Engine

To highlight the importance of a marketing growth engine to start-up and early-stage companies, it is worth recounting a recent experience we had with a company that approached us for funding.

The company in question was a start-up in the Internet-of-things (IoT) space. The team was smart and had built an innovative product that had won a small number of blue-chip clients who were paying the company both revenue and compliments.

They seemed set for big things, including a large round of investment.

However, all the investors they approached, including ourselves, came back to them with the same response: “No, but let’s stay in touch.”

They were confused because they thought that all a start-up had to do was demonstrate traction and they already had multiple blue-chip, revenue-paying customers and operated in the sexy, multi-billion-dollar IoT space.

But the capital wasn’t flowing their way. Why?

Because what they did could not point to was a marketing growth engine. They couldn’t demonstrate to investors that they had developed a repeatable and scalable method for cost-effectively attracting, activating and retaining customers.

Maybe all the customers were former colleagues or mates of mates. Maybe they just happened to be having a beer with the right person at the right time. Neither of those approaches are scalable, repeatable or predictable. They are not a marketing growth engine.

If you would like to discuss how CFSG Ventures can help your business rapidly accelerate its growth, we invite you to contact us.