Our latest news and analysis.

The M&A Lessons of Bondi Sands.

Another local success story has been snapped up by a global giant. This time it is homegrown self-tanning company Bondi Sands selling to Japanese beauty giant Kao Corporation. While a smaller transaction than the $3.7 purchase of Aesop by L’Oreal back in April, it is still a very large deal. Media outlets are reporting Bondi Sands’ shareholders are walking away with a very healthy $450m.

In this article we look at some key lessons from the transaction for anyone looking to sell their business.

The Business

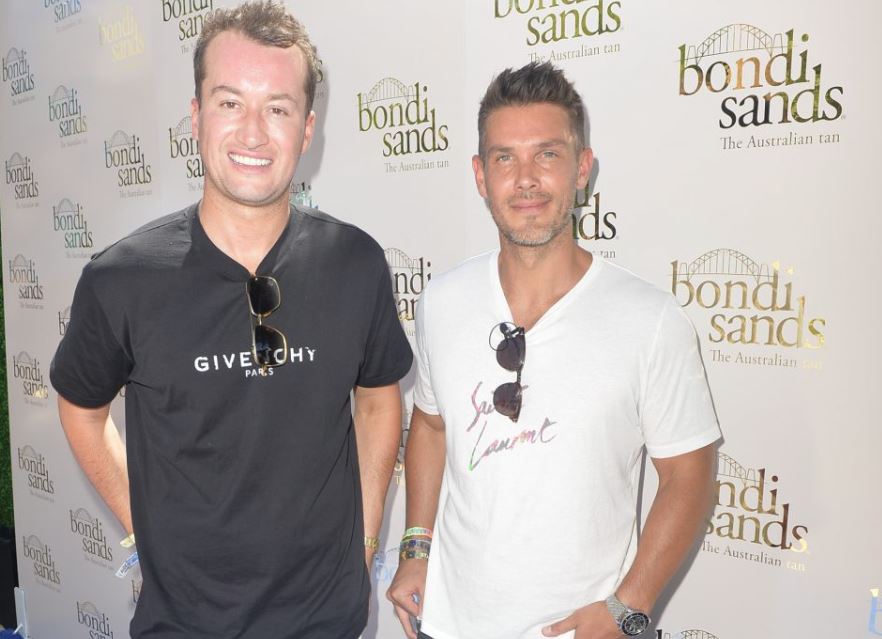

Bondi Sands was created in Melbourne in 2012 by Blair James and Shaun Wilson, son of former VFL player Garry Wilson (268 games for Fitzroy). The company manufactures and markets a range of self-tanning, SPF protection, body care and skincare products to some 22,000 stockists in 95 countries. According to the company’s website, it has more than 10 million active users globally and some two million followers on social media.

The business has grown rapidly. In fiscal 2019, according to ASIC, Bondi Sands reported sales of circa $50m and profit of $6.2m. In fiscal 2022, the business’ revenue more than doubled to $150.8m with profit climbing to $8.7m. The apparent decline in margins over that period would likely reflect the business’ focus on growth, particularly in the US.

Bondi Sands’ acquirer, Kao Corporation, is a Japanese chemical and cosmetics giant listed on the Tokyo stock exchange. The 136-year-old company has a market capitalisation in excess of AUD$25b.

The Sale Process

The media began reporting Bondi Sands was considering a sale back in May 2020. Those initial reports stated that Bondi Sands had appointed investment bankers who were conducting a “strategic review.” That’s always code for the business now being on the market. Those early media reports suggested that likely suitors would come from private equity groups or international consumer good giants such as Unilever or L’Oreal.

Perhaps due to the disruption of COVID, the next major news came in January 2021. The finance media reported the company’s bankers were set to launch a formal auction process. Interested parties – again trade and private equity buyers – were told to expect an information memorandum and a financial model in the coming weeks.

The business was being pitched as the world’s number one self-tanning company. There were also reports that the company wanted to wrap the process up by June 30 – ie. a six-month process.

Then in September 2021, it was reported that the sale was off. According to journalists, despite receiving offers from four potential buyers, the parties could not agree on price. There were suggestions that offers came in around $320m, which was substantially less than the owners’ expectations of around $500m. The founders thanked the interested parties and stated that they would refocus on Bondi Sands’ global growth ambitions.

While it is impossible to know what was happening behind the scenes, it seems it took another two years before a deal with Kao Corporation was announced. During that time, Bondi Sands continued its international expansion, having recently launched into Walmart in the US.

The sale is reportedly all-cash that will be split between the company’s three shareholders: Blair James, Shaun Wilson and Wilson’s father who was a seed investor. As part of the deal both James and Shaun Wilson will remain in their current roles of CEO and creative director respectively. Shaun Wilson stated a key reason for accepting the offer was being able to integrate with Kao Corporation’s scientific and technology resources. He stated this would enable the business to continue to grow and innovate.

The Lessons

Bondi Sands is obviously a wonderful successful story. The business started as nothing more than an idea. Blair James owned tanning bed salons in Melbourne. After the Victorian Government announced it was set to ban tanning beds, James needed to find a new venture. He had the idea for a self-tanning solution and teamed up with his friend Wilson to launch the business – from a living room.

So, what are some M&A lessons any business owner can draw from this sale?

Deals take time: It is interesting that the media first reported the company was gearing up for a sale back in May 2020. yet a deal was only finally announced in August 2023. That is more than three years later. While the media initially reported a desire for the deal to be done in six months, deals take time. Certainly, not every deal takes anywhere near that long. However, it is not uncommon for deals to start and stop, twist and turn before getting over the line. Patience is important.

Growth is important: Since its founding, Bondi Sands has demonstrated strong growth. Revenue between 2019 and 2022 grew at a compound annual growth rate of 44%. In addition, the business also grew its global market and store footprint. That is what an acquirer is buying – future growth. Demonstrating strong historical growth and clear future growth plans gives a buyer confidence that growth will continue. The more compelling a business’ growth story, the easier and more lucrative it will be to sell.

What’s your hook: Bondi Sands was able to market itself as the number 1 self-tanning product business in the world. Clearly, that is a compelling proposition. Any buyer in any market is going to be interested in buying the “number 1.” Now, you can’t claim to be number 1 if you are not. However, what Bondi Sands shows is the importance of having a hook. What is your claim to fame? Why should a potential acquirer give your business a second’s consideration? What’s in it for them? That’s your hook. Work on it.

Having to stick around: The media has reported that both founders will remain in their current roles. Clearly, these entrepreneurs are relatively young and remain energised to continue working in the business. However, it is most likely they would have found Bondi Sands far harder to sell – certainly for that price – if they wanted to rapidly exit the business. While some level of handover period is almost guaranteed in any business sale, sometimes extracting maximum value may demand a longer-term commitment to the business.

Sydney versus Melbourne: We all know that Melbourne and Sydney are perennial rivals. Sydneysiders always argue they have the better weather and the unbeatable Harbour. By contrast, we in Melbourne claim we are the sporting capital of the world with the better lifestyle and culture. What Bondi Sands shows is that two proud Melburnians will always tip their hats to Sydney if it helps them build a great business!

The founders of Bondi Sands have built an amazing Australian brand and business. They deserve all the success they have achieved. We wish them well and look forward to working with the next Australian success story. If you would like to discuss how we can help your business grow and achieve a major exit, please get in touch.