Our latest news and analysis.

How To Determine A Company’s Normalised Earnings

When a business owner is preparing their company for potential sale, a key piece of data that they will need to identify is their business’ historical earnings, particularly EBITDA (Earnings before Interest, Tax, Depreciation & Amortisation).

Acquirers tend to focus on EBITDA because it is seen (perhaps mistakenly) as a proxy for cash flow. It also allows for comparisons between companies because it ignores differences in depreciation and amortisation policies and individual financing and taxation structures.

EBITDA is a direct input in the most common method that a potential acquirer will use to value a business: the capitalisation of future maintainable earnings (“FME”). This approach determines the value of a business by multiplying the company’s FME by an appropriate multiple:

Future Maintainable Earnings X Capitalisation Multiple = Enterprise Value

For more information on earnings multiples, please click here.

For more information on enterprise value, please click here.

For the output of this calculation to be meaningful, however, it is essential that the FME figure accurately reflects the underlying, sustainable economic reality of the business. Arriving at this figure often requires owners and their advisors to make normalising adjustments to reported earnings.

Normalised Earnings – Public Companies

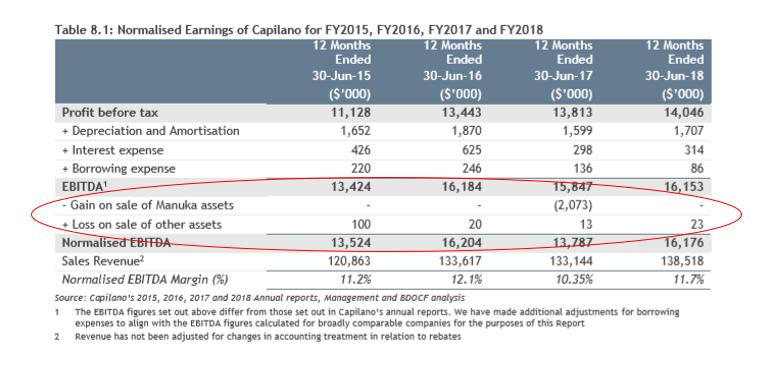

To see this exercise in action, we can refer to the independent expert’s report (“IER”) into the recent private equity bid for Capilano Honey. In arriving at Capilano’s FME, the IER identifies certain gains and losses on asset sales as non-recurring and makes the necessary normalising adjustments.

With public companies, it is relatively easy to identify the necessary normalising adjustments that are required. They are typically non-recurring items that are explicitly referred to in either the annual directors’ report or in the notes to the accounts.

Common non-recurring items that are often normalised to remove their impact include:

- Gains or losses on asset sales;

- Business restructuring costs (closing facilities, making staff redundant etc.);

- Costs of exploring new business opportunities;

- Exceptional professional services fees such as those paid for a one-time acquisition;

- Impairment charges for the write-down of goodwill;

- Significant fines or gains or losses in relation to litigation.

Normalised Earnings – Private Companies

The process of normalising private company accounts tends to be more complicated than it is for public companies A key reason for this is that private companies often do not operate at arm’s-length from their owners.

Therefore, in addition to the types of non-recurring items identified above, there are several additional normalising adjustments that need to be considered in the context of private companies, including:

- Owner salaries. It is important to review the salaries as well as any bonuses that are paid to the company’s owners. These amounts may be above or below what are deemed to be market rates for the provision of similar services.

- Owner-related expenses. It is not uncommon for company owners to put certain personal expenses through the business such as travel, entertainment, personal use of mobile phones and internet and so on.

- Family members. In private companies, it is not uncommon for family members to work within the business. The roles performed by and the salaries paid to family members need to be checked to determine whether they are commercial.

- External consultants. Private companies may also pay fees to external consultants who are family members or close friends and associates. As a result, these expense items need to also be reviewed for commerciality.

- Occupancy costs. It is not uncommon for a private company to rent premises from a related-party such as an owner’s superannuation fund. Therefore, the amounts paid for rent need to be reviewed and benchmarked against comparable market rents.

- Non-arm’s length transactions. In addition to rent, any revenue and expenses items that are linked to a related party need to be reviewed and assessed as to whether their terms are commercial.

The reality is that there are many possible normalising adjustments that could be made to EBITDA in the context of a private company sale and they are often a contentious part of the negotiations in any private company sale.

Nevertheless, as a prospective seller it is important that you have your own considered point of view as to what normalising adjustments should be made to your reported EBITDA figures before you engage with prospective purchasers.

If you would like to have a confidential discussion about how CFSG can assist you in successfully preparing for and completing the sale of your business, please contact us.